THE GROWTH CATALYST

Securing Series A Funding for Growth

EIC MBM

Published on December 2, 2024

"The best investment you can make is in the tools of your own trade." — Warren Buffett

Securing Series A funding is like auditioning for a reality show: momentum to convince investors you’re worth their millions (and their unsolicited advice). At this stage, startups are the awkward teenagers of the business world—no longer toddlers stumbling through MVPs but not quite the polished, revenue-generating grown-ups investors want them to be. However, navigating this phase requires a strategic approach to fundraising, understanding investor expectations, and executing a successful launch.

Understanding Series A Funding

Series A funding typically occurs after a startup has developed a Minimum Viable Product (MVP) and demonstrated early traction in the market. The objective is to secure sufficient capital to:

- Scale Operations: Expand the team, infrastructure and product development.

- Market Penetration: Increase brand visibility and capture a larger market share.

- Revenue Growth: Develop a sustainable revenue model.

Investors at this stage include venture capital (VC) firms, angel investors, and sometimes corporate investors. They look for startups with:

- Product-Market Fit: Evidence that the product solves a real problem for a defined audience.

- Growth Potential: Scalable business models with high market demand.

- Strong Leadership: Founders with a clear vision and execution capability.

Case Study: OYO Rooms (Because We Love a Good Glow-Up Story)

Background: In 2013, Ritesh Agarwal was a 19-year-old with a dream and maybe a questionable sleep schedule. He launched OYO Rooms to make booking affordable hotels as easy as ordering pizza. OYO Rooms started as a budget standardized rooms to travellers.

Early Traction:

OYO started by partnering with a handful of budget hotels and promising travellers clean sheets and free Wi-Fi—a revolutionary concept for some. Along with a focused MVP—offering budget hotel bookings with guaranteed quality standards. This clarity resonated with the market, helping them secure seed funding to build their initial platform.

Series A Journey:

In 2014, OYO raised $24 million in its Series A round led by Lightspeed Venture Partners and Sequoia Capital. This funding was pivotal in enabling OYO to:

- Scale Operations: Rapidly onboard hotel partners and expand its presence across India.

- Improve Technology: Invest in app development for seamless booking experiences.

- Brand Development: Launch aggressive marketing campaigns, positioning itself as the go-to budget accommodation brand.

Launch and Growth:

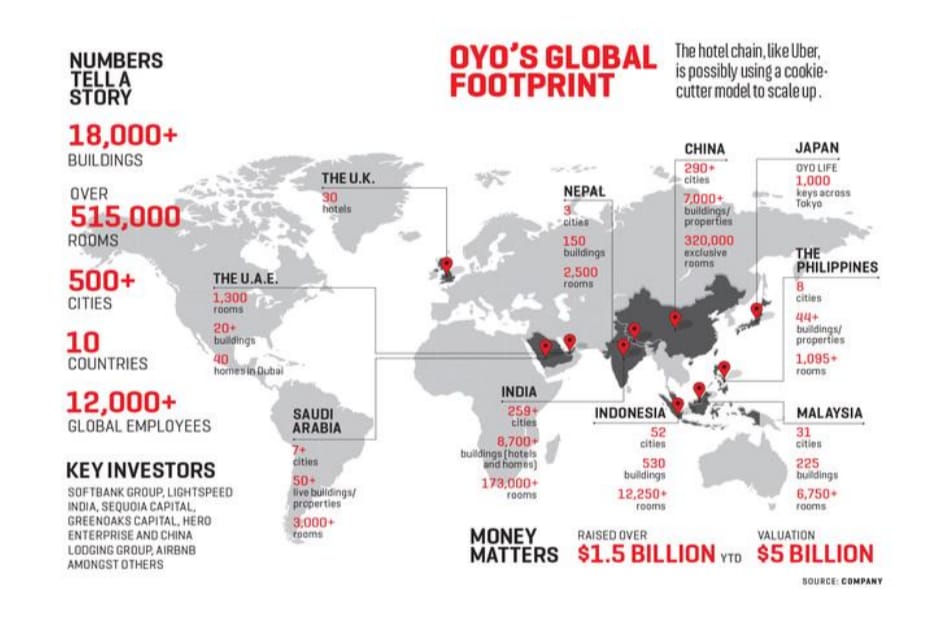

The Glow-Up: OYO went from budget-friendly MVP to a global hotel chain. The lesson? Start small but dream big—and maybe consider coffee sponsorships for those sleepless nights. With Series A funding, OYO focused on market expansion and user acquisition. By delivering consistent customer experiences, OYO gained customer trust, which set the foundation for subsequent funding rounds. Today, it operates in multiple countries, becoming one of the world's largest hotel chains.

Key Insights and Data

- Success Rates: Only 20% of startups that raise seed funding make it to Series A. (The rest? Probably pivoting or applying for Shark Tank.)

- Average Series A Round: As of 2023, Series A rounds in India typically raise between $5 million and $15 million.

- Investor Focus: Investors prioritize startups with annual revenue run rates exceeding $1 million at this stage.

- The Pitch Meeting Survival Rate: Only 10% of startups survive their first pitch meeting. (The rest? Still wondering if “um” is a deal-breaker.)

- Use of Funds Post-Series A: 35% goes to hiring talent, 30% to marketing, and the rest to “stuff founders forgot to budget for.”

- Survival of the Funded: Startups that don’t scale post-Series A often joke, “At least we made it this far.” (But seriously, hire a good financial planner.)

Conclusion: From Pitch Decks to Profit

Series A funding is your chance to prove your startup isn’t just a “cool idea”—it’s the next big thing. The journey is filled with ups, downs, and maybe some awkward networking conversations, but with resilience, strategy, and a bit of humor, you can transform your dream into a globally recognized business.

So, suit up, polish that pitch deck, and remember: Investors might be scary, but they’re also just people who really, really like ROI.