Optimization and IPO or merger

EIC MBM

Published on December 8, 2024

Mergers:In this scenario, both companies usually contribute their assets, technology, customer base, and expertise to create a stronger and more competitive entity. Mergers can be beneficial when companies have complementary products or services, want to expand into new markets, or seek synergies and cost savings.

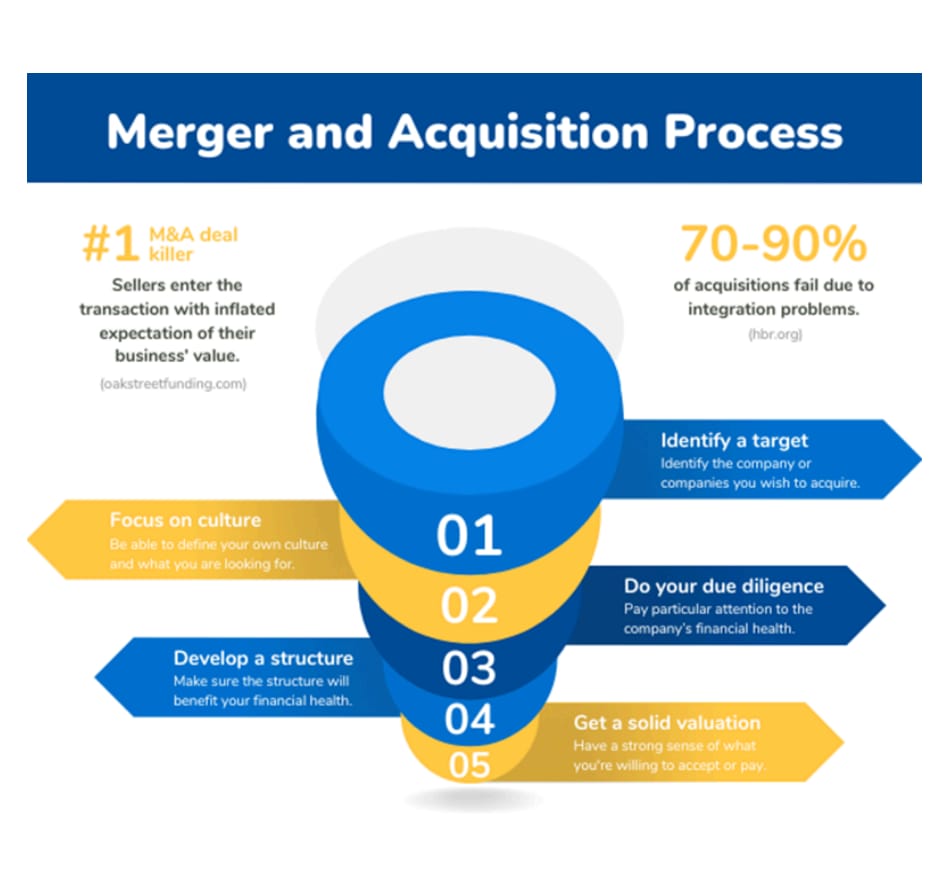

A typical merger or acquisition process involves five stages:

- Identify a target:Whether your company is interested in pursuing a merger of equals, an acquisition, or some other type of business consolidation, the first step is identifying the company or companies you wish to acquire. You may be coming to the merger and acquisition process with a target in mind -- such as having been invited to purchase a friendly competitor -- or you may be looking at a transaction as a way to accomplish longer-term business goals.

- Focus on culture:Mergers and acquisitions are rarely painless, and the most common pain points occur when the two companies have markedly different cultures. For example, your business may take an aggressive sales-oriented approach to business, while the company you’re considering is known for a more laid-back approach. Trying to combine very different cultures creates stress and dissatisfaction among employees of both organizations and often leads to greater-than-expected turnover and poorer-than-expected performance.

- Do your due diligence:On the surface, a company you’ve targeted for a merger or an acquisition may look attractive, but when you start to dig more deeply, you may discover issues of concern. It could be that key employees have contracts, potentially exposing you to significant payments.

- Develop a structure:Purchasing another business isn't like buying groceries, where a merchant sets a price, and you pay it without a second thought. Just as every transaction is different, there is no standard structure for mergers and acquisitions. Ideally, the structure of the transaction should benefit both the buyer and the seller, but your primary interest should be how it will affect the operations and financial health of your business. And remember that everything is negotiable. If the seller will not budge on the price, you may be able to adjust the payment terms to compensate.

- Get a solid valuation:When you prepare to sell a house or a car, you probably have a strong sense of what you're willing to accept for it and may even check websites like Zillow® or Kelley Blue Book® to verify whether your expectations are in line with the marketplace. It can be more challenging to pinpoint the value of your business. A major reason many transactions fall apart centers on disagreements about what the business is worth.

Initial Public Offering (IPO):

An IPO is the process through which a private company offers its shares to the public for the first time, listing them on a stock exchange. This allows the company to raise capital from public investors and provides liquidity to existing shareholders. After the IPO, the company becomes publicly traded, and its shares can be bought and sold by anyone on the stock market.As a pre-IPO private company, the business has grown with a relatively small number of shareholders including early investors like the founders, family, and friends along with professional investors such as venture capitalists or angel investors.An IPO is a big step for a company as it provides the company with access to raising a lot of money. This gives the company a greater ability to grow and expand. The increased transparency and share listing credibility can also be a factor in helping it obtain better terms when seeking borrowed funds as well.

What Is the IPO Process?

The IPO process essentially consists of two parts. The first is the pre-marketing phase of the offering, while the second is the initial public offering itself.

Steps to an IPO:

Proposals: Underwriters present proposals and valuations discussing their services, the best type of security to issue offering price,, amount of shares, and estimated time frame for the market offering.

Underwriter: The company chooses its underwriters and formally agrees to underwrite terms through an underwriting agreement.

Team: IPO teams are formed comprising underwriters, lawyers,certified public accountants (CPAs), and Securities and Exchange Commission (SEC) experts.

Documentation: Information regarding the company is compiled for required IPO documentation. The S-1 Registration Statement is the primary IPO filing document. It has two parts—the prospectus and the privately held filing information.

- The S-1 includes preliminary information about the expected date of the filing.

- It will be revised often throughout the pre-IPO process. The included prospectus is also revised continuously.

Marketing & Updates: Marketing materials are created for pre-marketing of the new stock issuance. Underwriters and executives market the share issuance to estimate demand and establish a final offering price.

Board & Processes: Form a board of directors and ensure processes for reporting auditable financial and accounting information every quarter.

Shares Issued: The company issues its shares on an IPO date. Capital from the primary issuance to shareholders is received as cash and recorded as stockholders' equity on the balance sheet. Subsequently, the balance sheet share value becomes dependent on the company’s stockholders' equity per share valuation comprehensively.

Post IPO: Some post-IPO provisions may be instituted. Underwriters may have a specified time frame to buy an additional amount of shares after the initial public offering (IPO) date. Meanwhile, certain investors may be subject to quiet periods.

Pros

- Can raise additional funds in the future through secondary offerings

- Attracts and retains better management and skilled employees through liquid stock equity participation (e.g. ESOPs)

- IPOs can give a company a lower cost of capital for both equity and debt

Cons

- Significant legal, accounting, and marketing costs arise, many of which are ongoing

- Increased time, effort, and attention required of management for reporting

- There is a loss of control and stronger agency problems